PH-EITI Signs Strategic MOU with Philippine Tax Academy to Advance Extractives Transparency and Public Financial Governance

Jollie Anne Las Piñas

Manila, Philippines | July 6, 2025

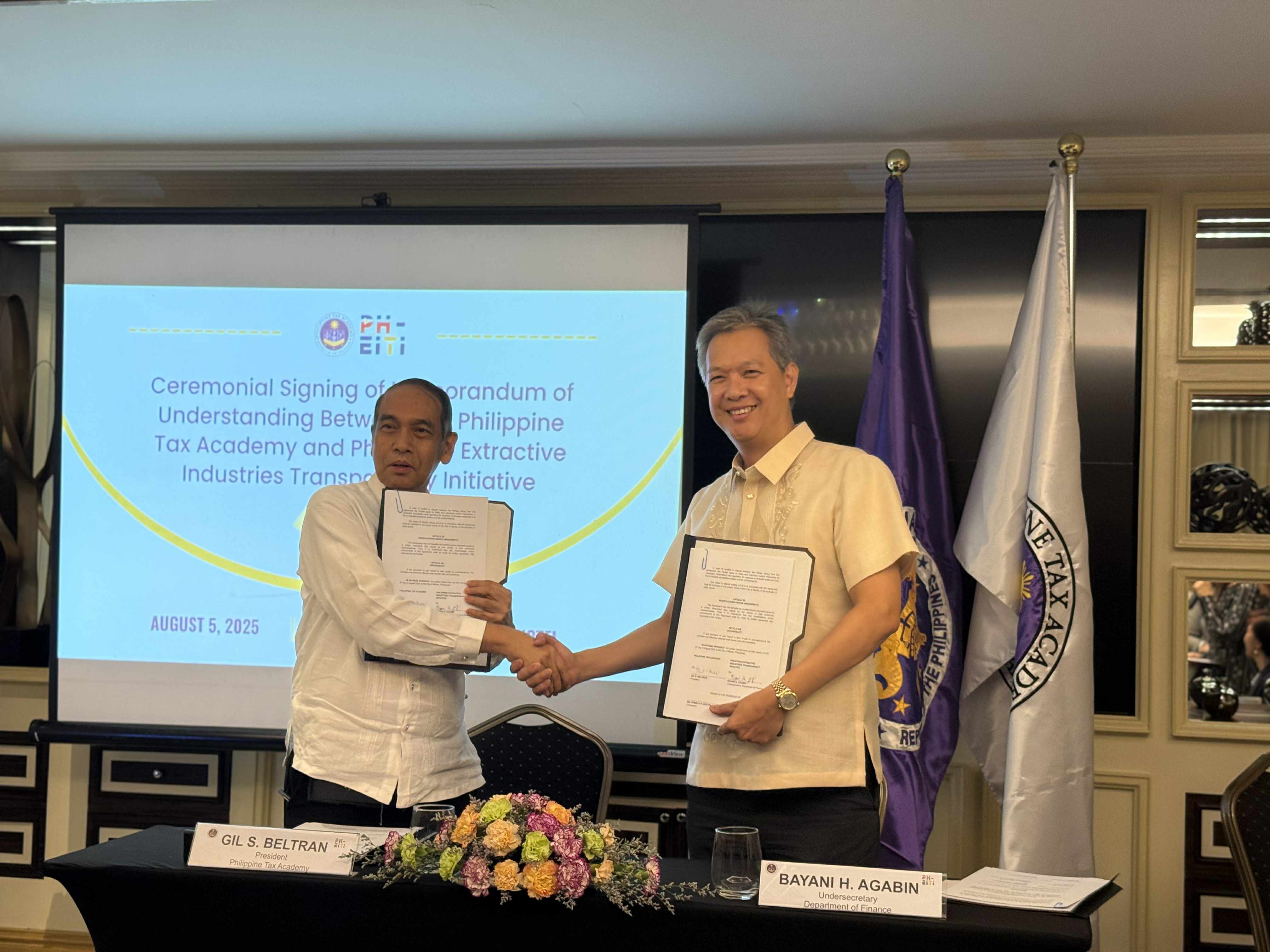

In the photo: Philippine Tax Academy President Gil S. Beltran and Department of Finance Undersecretary Bayani H. Agabin, PH-EITI Focal Person, present the signed Memorandum of Understanding during the ceremonial signing

The Philippine Extractive Industries Transparency Initiative (PH-EITI) and the Philippine Tax Academy (PTA) formalized a three-year partnership through a Memorandum of Understanding (MOU) signed today at the Diamond Hotel in Manila. The collaboration aims to strengthen fiscal literacy and enhance governance in the extractive sector through targeted capacity-building initiatives.

The MOU was signed by Department of Finance Undersecretary Bayani H. Agabin, who also serves as PH-EITI Focal Person and PTA President Gil S. Beltran. The ceremony was witnessed by representatives from the Internal Revenue Institute, Local Government Finance and Customs Institutes, and members of the PH-EITI Multi-Stakeholder Group (MSG).

Under the agreement, PTA will design and deliver specialized training programs, workshops, and seminars aligned with PH-EITI’s training plan. These programs will cover topics such as fiscal regimes, public finance, and natural resource governance, aimed at improving the capacity of PH-EITI stakeholders, including government agencies, civil society, and local governments.

In the photo: Representatives from the Philippine Tax Academy, PH-EITI, and Department of Finance pose for a commemorative photo following the MOU signing.

“This moment marks more than the formalization of an institutional partnership; it represents a shared commitment to good governance that is accountable, inclusive, and grounded in learning,” said Usec. Agabin in his remarks. He emphasized the importance of capacity-building in enabling stakeholders to understand complex fiscal data and participate meaningfully in governance processes.

The partnership allows PH-EITI to leverage PTA’s technical expertise in public financial management and instructional design. For its part, the PTA reaffirms its mandate under Republic Act No. 10143 to serve as the government’s training institution for tax administrators and fiscal officers. The Academy will provide course outlines and materials and issue certificates of completion to training participants.

“It is a call to action, a commitment to deepen awareness and public engagement through education, dialogue, and collaborative programs,” said PTA President Gil S. Beltran. “Through this partnership, the PTA will support the PH-EITI’s vital mission to communicate extractive industry transparency and foster public awareness — from policymakers to civil society, from industry stakeholders to communities directly affected by extractive operations. In doing so, we can affirm our role as a center of access for learning and professional development in public service.”

Both institutions anticipate that the partnership will enhance stakeholder understanding of extractive revenues and accountability mechanisms, thereby advancing PH-EITI’s mission of transparency and inclusive governance in the mining, oil, and gas sectors. The initiative is expected to empower local government units and civil society organizations to use extractive sector data more effectively in policy and development planning.

“Good governance is not a one-time achievement; it is a continuous process of learning, adaptation, and collaboration,” Agabin added, reaffirming PH-EITI’s commitment to sustained capacity development.

In the photo: Representatives from the Philippine Tax Academy, PH-EITI, and Department of Finance pose for a commemorative photo following the MOU signing.

About the Philippine Tax Academy

The Philippine tax Academy (PTA) was established under Section 4 of Republic Act No. 10143, enacted in 2010, to serve as the government’s premier learning institution for tax collectors and administrators. It is mandated to provide all training, continuing education programs, and specialized courses for officials and personnel of the Bureau of Internal Revenue (BIR), Bureau of Customs (BOC), and Bureau of Local Government Finance (BLGF), as well as selected applicants from the private sector.

The PTA aims to enhance the competence, efficiency, and ethical standards of public finance professionals across the country.

About PH-EITI

The Philippine Extractive Industries Transparency Initiative (PH-EITI) is a government-led, multi-stakeholder initiative housed under the Department of Finance. It implements the global EITI Standard, promoting open and accountable management of oil, gas, and mineral resources. Created through Executive Order No. 147 (s. 2013), PH-EITI works with government, industry, and civil society to ensure transparency and improve public understanding of extractive revenues and their contribution to national development.

A government-led, multi-stakeholder initiative implementing EITI, the global standard that promotes the open, accountable management, and good governance of oil, gas, and mineral resources. PH-EITI was created on 26 November 2013 through EO No. 147, s. of 2013. It is a government commitment first announced through EO No. 79, s. of 2012.